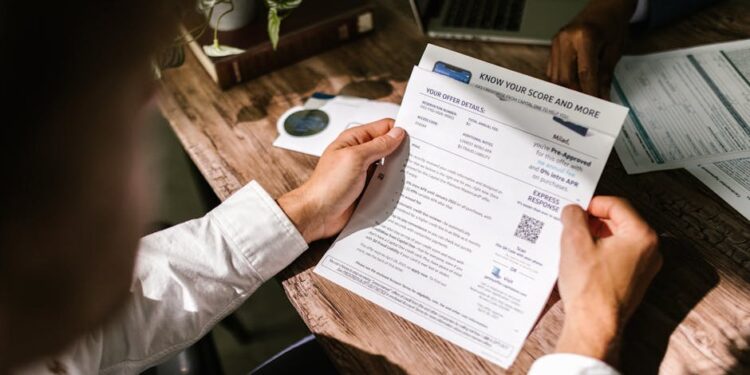

Experian, the global information services powerhouse, has long been a significant player in the realm of credit reporting and data analysis. Over the years, this behemoth of a company has witnessed its fair share of employee layoffs. These job cuts, while often based on strategic and economic reasoning, have rippling effects on its workforce and the markets it serves. Today, we explore the intricate tapestry of Experian’s employment dynamics, laying particular emphasis on the recent and upcoming layoffs and the forces driving these decisions.

A Brief Look at Experian

Understanding Experian begins with acknowledging its global reach and influence. This company is a titan in information services, primarily known for credit reports and data insights. Experian operates in over 40 countries, affecting millions of consumers by providing crucial financial data. But with great reach comes great responsibility—and sometimes, strategic downsizing.

Experian has always focused on innovation, keeping pace with the rapid changes in digital finance. However, economic turbulence and shifting business strategies have forced the company to adapt its workforce periodically. Experian’s workforce dynamics tell the tale of an enterprise continually seeking balance between growth and efficiency.

Experian Layoffs 2025

In 2025, the landscape for Experian’s workforce remains uncertain, as rumors suggest impending job reductions. These anticipated layoffs are seen as an extension of the broader shifts within the company. While exact numbers are yet to be confirmed, whispers from within indicate a calculated approach to workforce optimization in response to market conditions.

The technological landscape is rapidly evolving, and Experian, at its core, is a tech-driven entity. Ensuring its team aligns with the latest innovations necessitates reevaluating its workforce. As the company transitions, workforce adjustments seem inevitable, fueled by both strategic realignments and external economic pressures.

Expect these job cuts to be part of a broader effort to adjust to technological shifts and market demands. The emphasis might be on departments less aligned with Experian’s forward-looking technology strategy.

A Detailed Analysis of Experian 2024 Layoffs

The 2024 layoffs were shrouded in ambiguity, yet they hinted at deeper strategic decisions within Experian. Though official details remained sparse, these job cuts reinforced the notion that even giants need recalibration.

Aggressive market competition, along with the need to streamline operations, was a likely catalyst behind these job losses. Despite the hurdles, Experian maintained its commitment to innovation, striving to remain ahead in the data analytics game. These layoffs were strategic, focusing on aligning departments with future business goals.

As part of the 2024 workforce reductions, employees from specific locations, such as the Allen, Texas office, faced job losses while operations expanded in other locales. This disparity underscored the localized nature of the layoffs, which aligned with various demands and constraints across global operations.

Employee sentiments following the layoffs were mixed. Many expressed concerns regarding job security, underscoring a growing unease within the company. The impact on employee morale highlighted a need for effective communication from leadership, emphasizing the importance of transparency during such trying times.

Key Points Behind These Layoffs

The reasons driving these layoffs are multifaceted. Economic pressures are a central factor. Experian, like many global firms, navigates a challenging financial landscape, necessitating cost controls. Streamlining operations became essential to maintaining competitive advantage.

Moreover, strategic realignment plays a crucial role. As technology evolves, so must Experian’s workforce. This means focusing on departments and skills pivotal to current and future objectives. Layoffs, while difficult, often form part of realigning human resources with the company’s strategic pathway.

Global economic volatility also exerted influence. Fluctuations in market demand and currency exchange rates further complicated strategic planning, prompting a reassessment of human capital requirements. In essence, layoffs at Experian emerge as responses to shifting priorities in a dynamic business environment.

Are Layoffs Part of a Bigger Industry Trend?

Looking beyond Experian, the broader industry is no stranger to layoffs. Across various sectors, particularly tech and finance, job cuts have become increasingly commonplace. The quest for efficiency, coupled with economic uncertainties, is a shared challenge.

Companies are compelled to optimize resources amidst this landscape. The digital economy demands innovation, prompting businesses to prioritize key growth areas, often at the expense of others. As such, Experian’s layoffs align with a wider industry narrative, where strategic realignment dictates workforce shifts.

Understanding this trend involves acknowledging technological advances and evolving customer needs. Firms continue to adapt, reshaping their teams to stay relevant and competitive. This evolution, while disruptive, reflects the necessity to thrive in a rapidly changing market.

Experian Business Model

At its core, Experian thrives on data. This company collects, analyzes, and offers insights from vast amounts of information. While this model proves lucrative, it requires constant innovation and adaptation to market changes.

Experian monetizes data by providing valuable insights to both businesses and consumers, informing financial decisions with precision. Yet, maintaining this leading position demands a workforce attuned to technological advancements and market demands.

The company maintains a diverse portfolio, extending beyond credit reporting to encompass decision analytics and marketing services. This diversity is both a strength and challenge, requiring a nimble, skilled workforce to navigate different sectors effectively.

Strategic layoffs, while unsettling, can refocus human resources where they are most impactful. Experian is tasked with continuously molding its team to effectively execute its business model, ensuring pioneering information services and maximum client satisfaction.

Financial Performance Of Experian

Financially, Experian boasts resilience in challenging times. The company’s performance, fluctuating with market conditions, exhibits an ability to adapt and grow despite external pressures.

Revenues from existing pillars, complemented by innovations in analytics and marketing services, bolster Experian’s financial stability. Layoffs, though indicative of underlying challenges, often facilitate strategic realignment to enhance profitability.

Investors continue to scrutinize Experian’s financial trajectory, as the company balances growth ambitions with sustainable operations. The strategic decisions taken today, including workforce adjustments, are critical to ensuring ongoing financial health and market leadership.

Experian’s robust financial performance underlines its adeptness at navigating complex economic terrains. Such resilience is key, ensuring the company remains a forerunner in information services, adjusting dynamically to changing environments.

Conclusion

Examining Experian’s layoffs reveals deeper insights into the company’s strategic priorities and industry trends. Changes in the workforce, while challenging, are often necessary to keep pace with evolving technologies and market conditions.

Experian, like others in its sector, navigates a complex landscape, balancing growth with operational efficiency. The company’s ability to reorient its workforce in response to shifting priorities lies at the heart of its enduring success.

In times of uncertainty, effective communication with employees becomes crucial, ensuring morale and motivation remain high. Experian’s journey illustrates a broader narrative, one where strategic foresight underpins resilience and sustained relevance in the global information services arena.

For a detailed exploration of business strategies, workforce trends, and financial insights, check out our website.